Hey friends,

Earlier this week I completed my 4th acquisition of micro SaaS apps and I’ve been looking forward to sharing the details with you all.

If you’re new to the newsletter, you may want to read the post, The Holding Company, to learn how I got into the acquisition game.

The opportunity

About 6 weeks ago I came across a listing on Acquire.com that immediately caught my eye. The listing was for a collection of 3 SaaS apps, 1 Slack app, and 2 Monday.com apps. The sellers were asking for $15k USD for all 3 apps.

Since my 2nd and 3rd acquisitions were Slack apps, and I know Monday was growing quickly, I was intrigued.

All 3 apps were making money. The Slack app was making roughly $300 a month, and the Monday apps were doing $258 and $197 in MRR. In total the 3 apps were doing roughly $750 MRR, or $9k ARR. 15k to purchase 9k in ARR is a great multiple and since both the Monday apps were growing consistently month over month, the economics of the opportunity looked fantastic. I would get the majority of my investment back in the first 12 months and it would be difficult to lose money on this deal.

I sent over a letter of intent (LOI) to purchase the apps for $15k and fortunately the sellers accepted it. I got started on my due diligence which took about 2 weeks.

I was lucky that the sellers were two great guys who were very supportive throughout the entire process. During the due diligence I didn’t see any red flags and decided to move forward with the purchase.

After a few weeks of “handover” the acquisition was done and on Wednesday I indicated to Escrow.com that the handover was completed and that the funds should be released to the seller.

So at this point I bet you’re wondering what are the apps that I purchased? You can see all 3 apps at https://www.change1t.com/.

Pros and cons of the acquisition and future plans for the 3 apps

I’ve yet to make a “perfect” acquisition. The goal is to check the most important checkboxes and all 3 of the apps I now own through the acquisition check those boxes.

In short, I like apps which are mature, easy to understand, are B2B, have very low churn, get organic exposure, and do one thing very well. See my acquisition checklist in this post.

The pros:

Mature apps which do what they are intended to do —> No additional development is needed.

Diversification —> I now have apps across both Slack and Monday. This provides a bit of protection against platform risk.

Simple tech which requires little to no maintenance.

Exist on platforms which drive exposure —> No marketing is needed, growth happens organically.

B2B and great exposure to enterprise clients —> Major banks, insurance companies and large tech companies are included in the list of customers across the 3 apps.

Low churn.

All 3 apps have expansion MRR —> There is an opportunity for existing clients to pay more over time.

The cons:

Slow growing —> Roster for Slack’s MRR is flat since December while the Monday apps are adding 1 - 2 new subscriptions a month. The good news is that occassionally the new subscription pays annually and can be north of $1k in size.

3 apps equals more support tickets —> I now have 6 apps in the portfolio. This acquisition doubled the number of apps I have to support which means more time needed for answering support tickets.

Need to know a new platform —> By now I know the Slack ecosystem very well since I’ve acquired 2 SaaS which serve thousands of businesses on Slack. I’m new to Monday and even though there is now more diversification across the portfolio, I have to spend time getting familiar with a new app marketplace, processes etc.

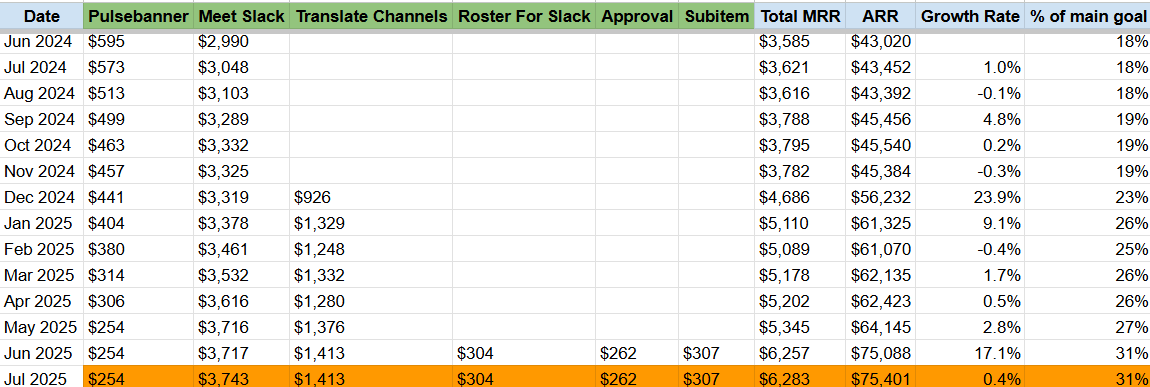

An additional $750 MRR is nice but doesn’t change the game —> The acquisition added 17% to my total MRR which is great. It took me from $5.3k to roughly $6.1k in total MRR. The hope now is that the MRR across the 3 apps will grow nicely pushing me closer to my MRR goals.

Plans for the 3 apps

My thesis for these 3 apps is very similar to the previous 2 acquisitions.

The plan is to keep them as small cash cows which will hopefully grow by 25 - 50% a year with little to no input by me. As I wrote above, the economics of the deal were very good so I expect to get my money back in 1 - 1.5 years, depending on the growth rate of the apps.

I don’t plan on doing any additional development or marketing of the apps. There are some small adjustments such as adding an email onboarding flow to each app, and trying to generate reviews for the Monday apps which should help with adoption and growth.

The road to 20k MRR

This most recent acquisition has taken my total MRR across the SaaS to over $6k. Both Meet Slack, and Translate Channels, my 2nd and 3rd acquisitions are growing nicely and hopefully we’ll be close to $7k MRR before the year is up. Anything over $6.5k would be great.

So far this year the SaaS has been crushing.

Over $33k in revenue has been collected which is over 47% year-over-year growth (July is shown in the table above, but the month just started).

I’m expecting over $70k in revenue from the portfolio by the end of the year with gross margins over 85%.

A lot of the profits from the SaaS are being funneled into further development of Feedio but soon I will be pulling back to improve margins and our cash position.

Final thoughts on the acquisition and plans for getting to 20k MRR

Overall I’m very happy with the latest acquisition. I’m confident the $15k investment will provide a great return over the next few years and this will help me reach my bigger goals.

One important lesson from the acquisition is that I now have to be patient and have the discipline to ignore these smaller deals.

My overall strategy of building a portfolio of SaaS that generates cash flow for a great lifestyle, and additional investments, doesn’t scale well if the portfolio is made up of apps generating a few hundred dollars in MRR, even if they are being sold for a bargain.

The next deal I make needs to be for a SaaS doing at least $1.5k MRR, and ideally closer to $5k MRR. The growth rate of the next SaaS I acquire also needs to be at least 25% a year. The real compounding comes from organic growth. Buying SaaS that aren’t growing, or barely growing doesn’t get me to where I want to be.

To acquire a SaaS doing $5k MRR (60k ARR) will cost between $180k - $300k (3X - 5X ARR, without seller financing). It’s going to take time to build up this amount of cash so I’ve got to be patience.

I’m also slowly researching the idea of starting a fund / doing syndicated deals, but at least for now going that route doesn’t seem viable.

Thanks for reading and have a great weekend.

Justin