Over a year ago I came across a very interesting Internet personality by the name of Andrew Wilkinson. I first heard about Andrew through the My First Million Podcast, in which he appears quite frequently.

Andrew Wilkinson is an extremely successful online entrepreneur who got started in 2007 as an agency owner doing design work for some of the best known tech companies in the world. His agency, Metalab, can name Slack, Google and Uber as past clients.

Metalab’s success provided Andrew with significant cash which was funneled into the development of new SaaS businesses. One such example is Flow, a task / project management solution that went head-to-head with Asana. Andrew shares in a Twitter thread how he lost over $10 million dollars fighting this battle.

Fast forward to 2013, and after learning about Warren Buffet and Berkshire Hathaway, Andrew founds Tiny, a holding company. Instead of starting new businesses, profits would funnel up to Tiny which in turn would buy existing businesses.

Today Tiny has 80 businesses under its umbrella.

Learning about Andrew Wilkinson, Tiny and how he went from service provider to agency owner to investor was a game changer for me.

In a previous newsletter I wrote about the “challenge” of running a profitable agency. Andrew had more or less mapped out the solution for me.

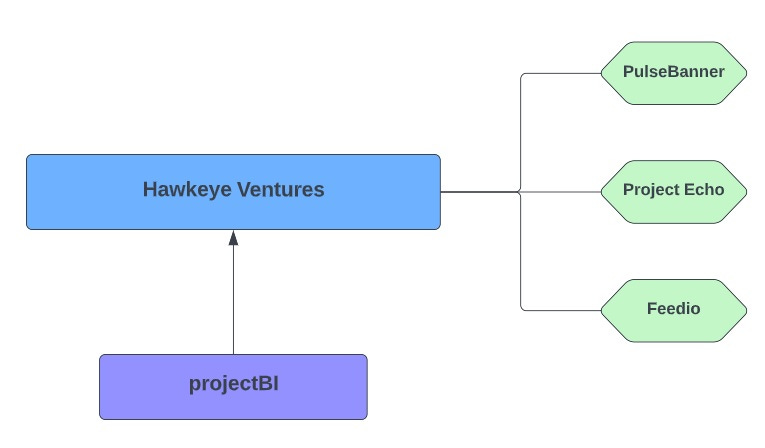

I decided I would create a holding company which would use the cash generated from my agency, projectBI to acquire and develop online assets.

The name of my holding company is Hawkeye Ventures, and it was officially formed in September last year, just before I finalizing my first acquisition.

PulseBanner is Hawkeye Ventures’ first cash flowing SaaS. Project Echo is currently in alpha and Feedio will be covered in its’ own newsletter sometime in the future.

Unfortunately when I formed projectBI as a company, I didn’t do it in the smartest way so I’m going to need to make some structural changes. When everything is set up correctly Hawkeye Ventures will own 100% of projectBI and profits will flow from the one entity to the other without double taxation.

My hope is that by the end of this year I’ll be in a position to make a 2nd acquisition and get my monthly recurring revenue (MRR) from SaaS to over $5,000. It all depends on how the agency performs, and if I manage to prove product market fit for Project Echo or Feedio.

If either Project Echo or Feedio takes off, I’ll be more inclined to invest any extra cash in growing these services, than acquiring another.

Time will tell and I’m excited to share my journey with you all.

Thanks for reading and if you enjoyed this edition, please consider hitting the share button below.