Hey friends,

I recently shared that I was close to wrapping up the purchase of another micro SaaS.

In this post I’m going to share details on the latest addition to Hawkeye Venture’s portfolio, Translate Channels.

The holdco play and current portfolio

Some quick background to those that are new to Coffee + Revelation.

In mid-2022 I decided to build a holding company and start acquiring SaaS products. I learnt this approach from Andrew Wilkinson who is a regular on the My First Million podcast. I covered this topic in detail in this post, The Holding Company.

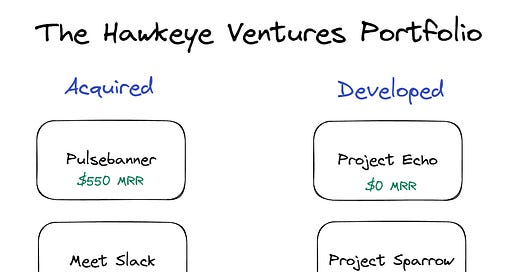

My holding company, Hawkeye Ventures, Inc was established in Nov 2022 at the same time as my first acquisition, PulseBanner.

In June 2023 I made my 2nd acquisition, Meet Slack. I first mentioned Meet Slack in this post.

In early 2024 my team and I at projectBI started developing 2 SaaS products, Project Echo and Project Sparrow. These data-related products are used internally at projectBI and have not yet been monetized.

About 2 months ago I started the process of gaining full ownership of Feedio, a SaaS that I first started working on with a co-founder over 10 years ago. Feedio is my “big play” for 2025.

Yesterday I released the Escrow payment to complete the acquisition of Translate Channels.

Introducing Translate Channels

When I first came across Translate Channels on Acquire.com I was immediately intrigued. There were a lot of similarities between Translate Channels and my 2nd acquisition, Meet Slack.

B2B

Slack app

Selling for a <3.5X ARR multiple

Simple to understand

Does one thing very well

No complex tech or other dependencies

High margin (>80% net profit)

Translate Channels automatically translates messages sent in designated Slack channels. It leverages the Google Translate API which covers over 100 languages.

It has a usage-based pricing model which is easy to understand. The cost for each member that uses the app is $5. It was $4 but I increased it to $5 for new subscribers.

The app is currently doing about $1.3k a month in revenue across about 35 subscribers. Growth is very slow but there is good retention and there are about a dozen subscribers who have been paying for the service on a monthly basis for over 18 months. Average monthly payments range from $5 to $200 per subscriber.

There are between 10 and 20 new signups every month completely organically through the marketplace with about 60% of them opting into the trial. I also extended the trial from 7 days to 14 days. I did this because the data shows that once workspaces are using it at scale (>3 members) the likelihood of cancelling is low.

The handover process was very smooth. The previous owner is a great guy and it was an absolute pleasure working with him throughout the process. I took my time with the due diligence and the previous owner even agreed to make certain changes to the service which helped improve margins.

Since the deal has just been closed I’m not going to reveal the purchase price but I will say that I’ve modelled out numerous potential outcomes and the likelihood of losing money on this deal is extremely low. Assuming zero growth and price increases and I’ll make my money back in 3 years. The app has grown 47% in the last 12 months running at $4 a user.

My thesis for buying Translate Channels was quite simple. I see it as a small piece of “digital real-estate” that should provide a high annualized return with little to no time commitment. I won’t get rich from Translate Channels but it will continue to provide a growing stream of cash flow that I can then reinvest in acquisitions or growing other SaaS in the portfolio.

One of my big goals is to reach $20k MRR in pre-tax profit from SaaS. Translate Channels is another step towards hitting this milestone.

So what’s next for Hawkeye Ventures and the portfolio?

One of my goals for 2025 is to reach $10k in MRR from software (50% of my 20k MRR long-term goal). As I’ve shown above we are at $5.25k which means I need another $4.75k in net MRR to hit the target.

Meet Slack and Translate Channels will continue to grow and a conservative estimate is I’ll gain another $1.5k - $2.5k in MRR next year across the 2 apps.

That means I need to generate $2.25k - 3.25k in MRR from Feedio, Project Echo, Project Sparrow or a new acquisition by the end of next year.

It’s unlikely I’ll have the means to acquire another SaaS in 2025, unless things really take off with my agency, projectBI. The acquisition of Translate Channels has depleted my cash reservers so the focus will be on building up runway and a new war chest which takes time.

I’m betting big on Feedio in 2025. I have a whole team working on improving the service and will continue to bootstrap development until at least the end of Q1. The hope is that by that stage the service has some MRR and I’ll be in a position to start raising a seed round.

Thanks for reading and if you enjoyed this edition of Coffee + Revelation, consider sharing it on your social channels so others can find my content.

This is incredible and thank you for being willing to share these details! Hope you reach your goals 💪